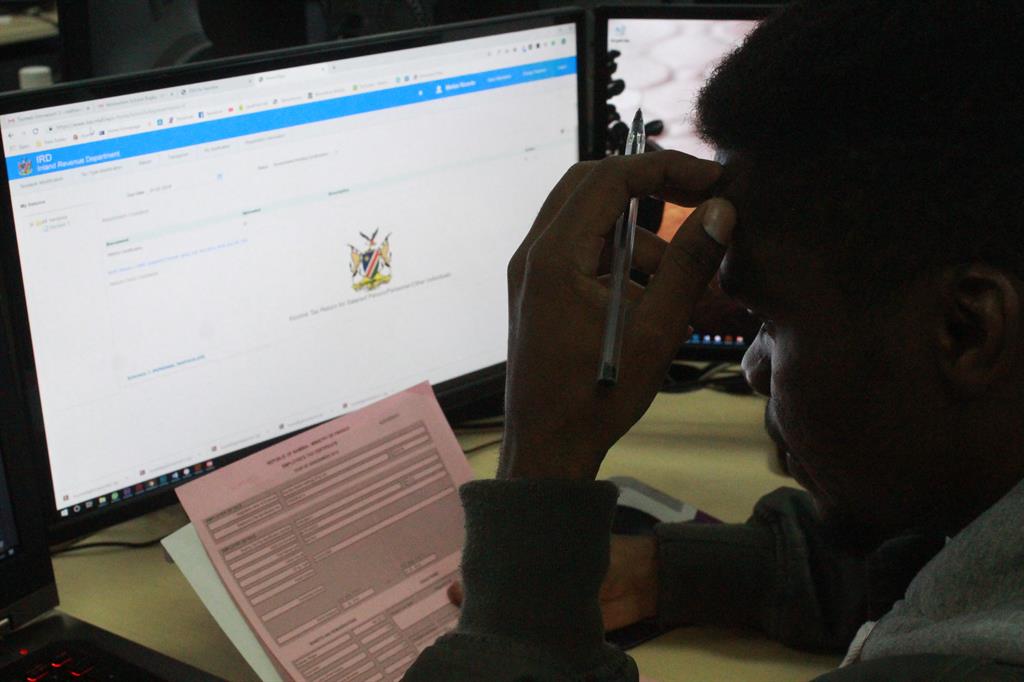

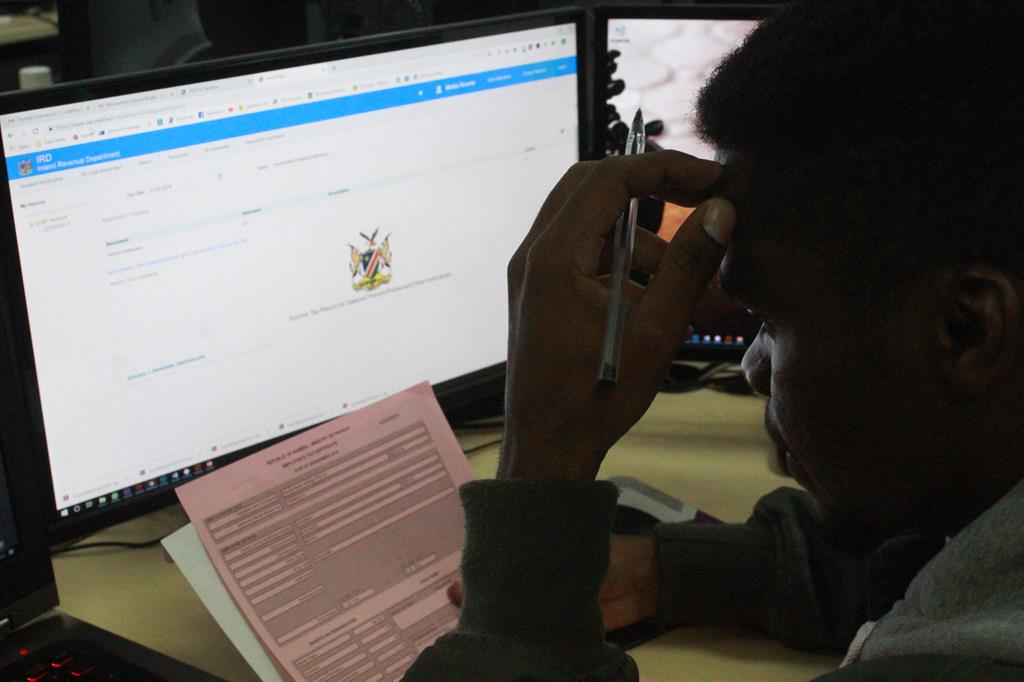

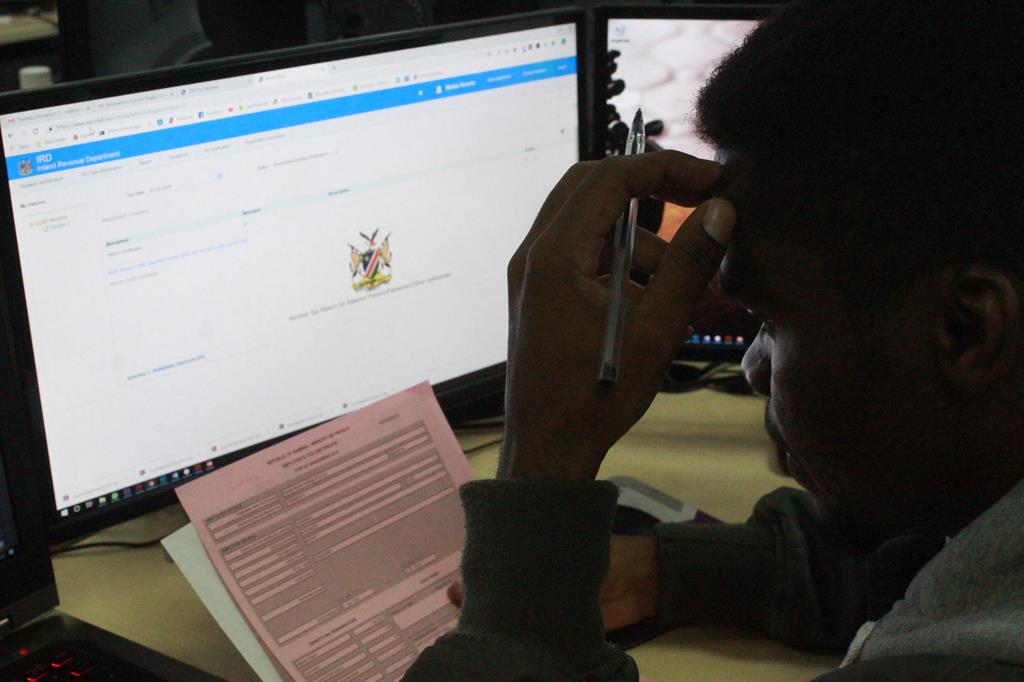

Filing tax returns online

ITAS offers a self-service functionality to taxpayers, and the turnaround is immediate.

Elizabeth JosephThe Integrated Tax Administration System (ITAS) is a technology solution that allows taxpayers to file their returns online, which creates ease and comfort.

A feasibility study was done during 2008/09 to determine whether the finance ministry should procure a new system or enhance the existing TAXLIVE system.

It was found that it would be more expensive to enhance the existing system, hence the recommendation to acquire the new system.

It took close to nine years, including the time taken for the feasibility study, and on 17 January, ITAS became operational.

The Zone spoke with ITAS project manager Sirkka Masilo. She said that specific statistics are not available at the moment on how many young people make use of this online portal.

Asked how well tax-paying youth are embracing this new revolution, she said: “There has also been growing apprehension because many people could not undo the puzzle on how to use ITAS. It is not really a concern for us here, although ITAS is new, it is extremely simple to use.”

Jessica Ulrich, a life skills teacher at Delta Secondary School, said their grade 12 learners have been taught about the online portal.

“It’s was only in the curriculum for grade 12s, but has moved into the new grade 11 syllabus material.”

“And we have explicitly taught the online portal registration to them,” she said.

Masilo said the finance ministry has a training division responsible for giving tax training to all employed officials.

ITAS offers a self-service functionality to taxpayers, and the turnaround is immediate. This service allows taxpayers to register, file and update their basic information, view their accounts and returns and search for generic information, etc.

“The expectation is for all taxpayers to register on portal as e-filers as soon as possible. In addition, we have set up return filing centres countywide to assist those who need assistance. Although, we still accept manual returns, we don’t encourage taxpayers to do so,” Masilo added.

Comments

My Zone

No comments have been left on this article