Nedbank announces new finance offerings

Nedbank Namibia recently announced its new vehicle asset financing offering at breakfast engagement where key finance and insurance stakeholders had an opportunity to network and compare notes.“Vehicle asset finance is a very important facet of our economy. Not only does it contribute through taxes and levies, but also enables people to engage in revenue-generating activities. This makes it a very important sector in which stakeholders need to innovate and bring competitive products to the market to spur its continued growth,” Amanda von Wielligh, head of vehicle and asset finance at the bank, said.

“That is why we are very excited to announce our new financing options, as we feel that we have a very competitive offering that will grow our participation in this sector and give back to dealers and customers in assisting to make the owning of their desired vehicle more affordable,” she added.

Across the spectrum

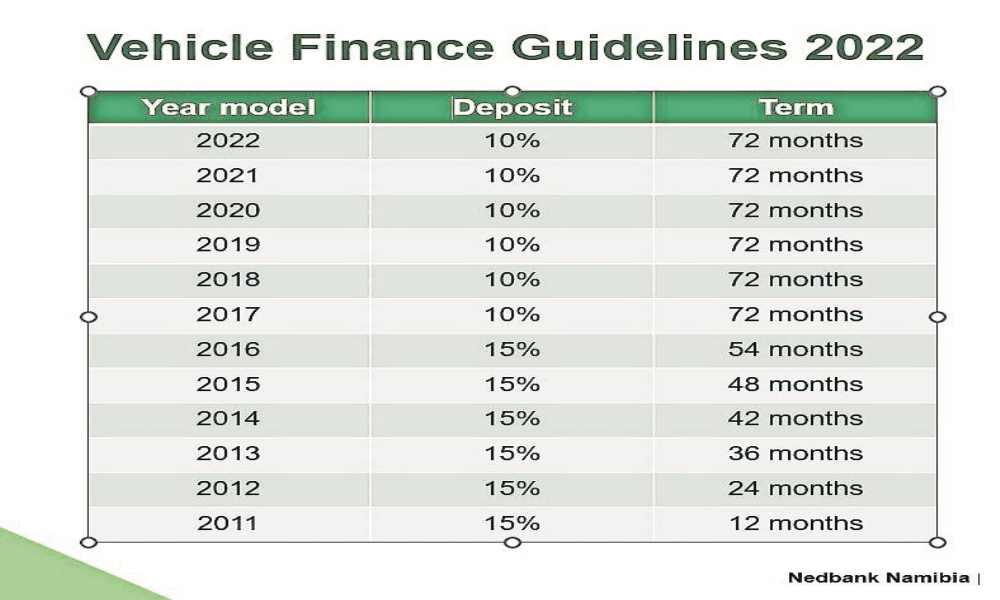

“We wanted to cater to every segment of the market by not only making the purchase of newer vehicles more affordable, but also offering a facility for older vehicles, like your lifestyle bakkies, which have been carefully and lovingly accessorised to fit the owners’ tastes and requirements.”

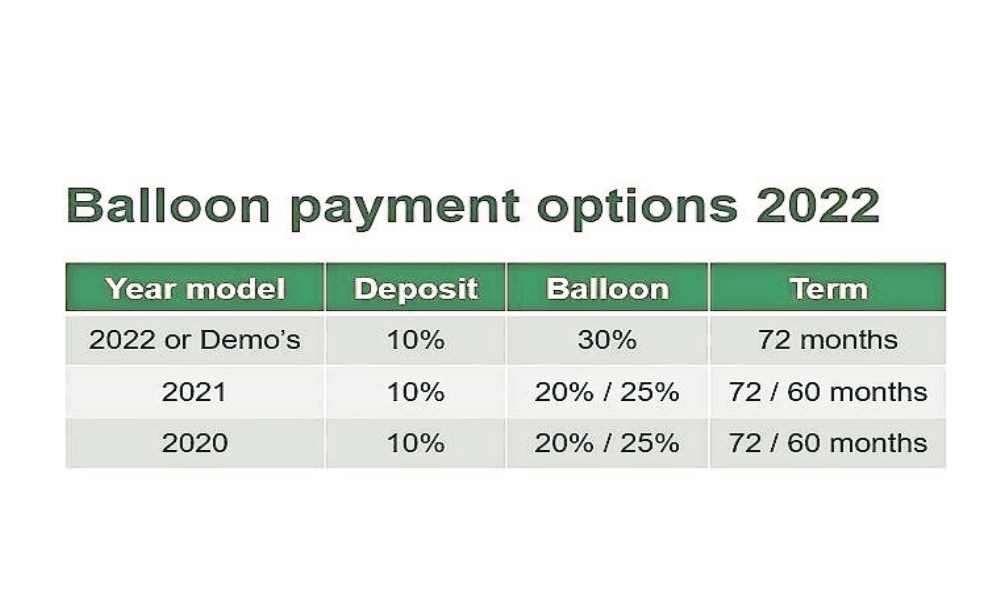

This also includes the introduction of balloon-payment options for pre-owned and demo vehicles which fall within a specific period.

Von Wielligh went on to encourage clients to get in contact with their nearest Nedbank consultant, as the team is committed to helping you structure your vehicle finance in a way that works for you.

“No matter how exacting your personal requirements, talk to us. You can negotiate your monthly payments with your branch, arrange payment terms to suit your circumstances and be assured of getting a competitive deal plus the personal, professional attention you deserve,” she said.

Comments

My Zone

No comments have been left on this article